In our last blog, we discussed how some underwriting teams are drowning in submissions and why it makes good business sense to respond to all of them. In short: responding to all submissions helps maintain important distribution relationships and introduces the opportunity to quote more business and thus write more premium.

Today, we’re going to pick up where we left off: how you can address the influx of submissions by leveraging technology. Finding the right solution comes down to assembling the right set of capabilities to meet your business requirements. In this particular use case, companies that are inundated with submissions can benefit tremendously from finding a solution that will not only complete the intake process in a timely, accurate manner, but can also apply rules that help prioritize and ultimately surface the best opportunities for underwriters to focus on. As you are evaluating technology solutions, here are some core capabilities you should look for:

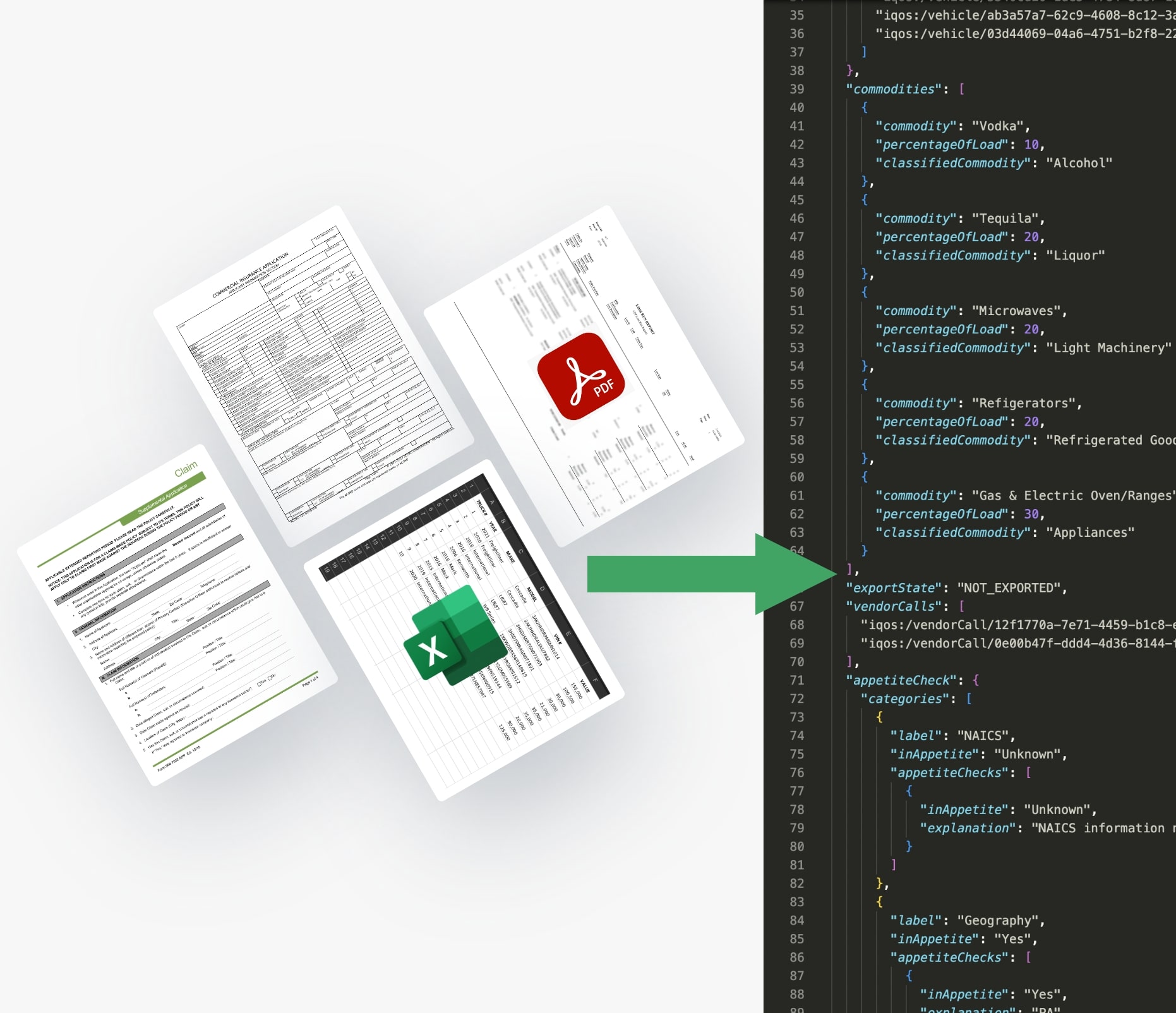

#1: Turning the mass of submissions into actionable data for underwriting

One of the key pain points we hear is around getting data out of the inbox and into a usable format for underwriting. Surprisingly, this is still a highly manual process, with people often forced to enter data multiple times, which takes time and increases potential for human error. Ingestion technology leverages AI and machine learning methodologies to extract the key data needed to evaluate submissions and convert them into a consistent, usable format.

Bonus: Some offerings, like Groundspeed, leverage a hybrid approach combining the power of AI with a human-in-the-loop to get the best of both worlds: data that is both fast and accurate.

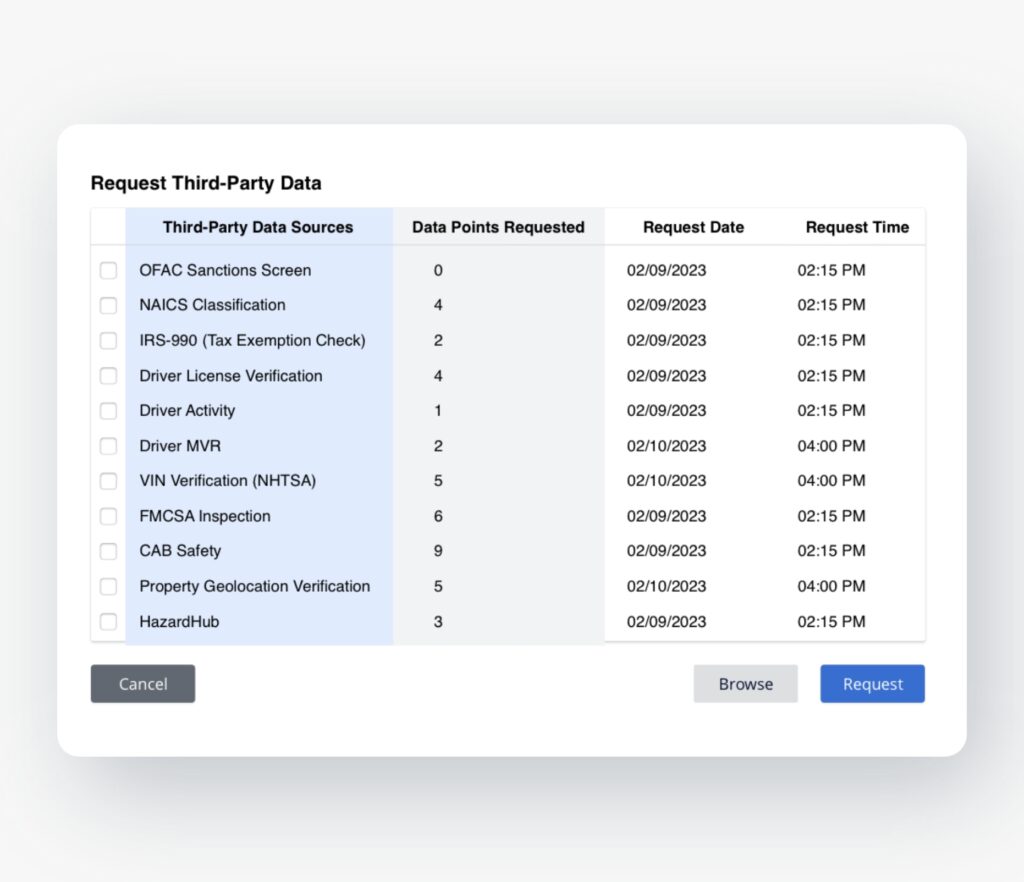

#2: Validating and enhancing the ingested data through verified, third-party sources

Extracting information is important, but even nicely formatted data frequently has gaps and needs verifying before you can call it complete and ready for an underwriter. This is where enrichment as a capability comes in. By layering third-party data sources on top of your ingested data, you can fill information gaps, reducing back-and-forth with your broker while also building in checks and balances to validate the quality of the information and reduce potential risk to your business.

Bonus: Some offerings, like SubmissionIQ, include this capability in a user interface where you are guided through a workflow experience to see the information gaps, as well as call the third-party sources they want to use for validation via API integration.

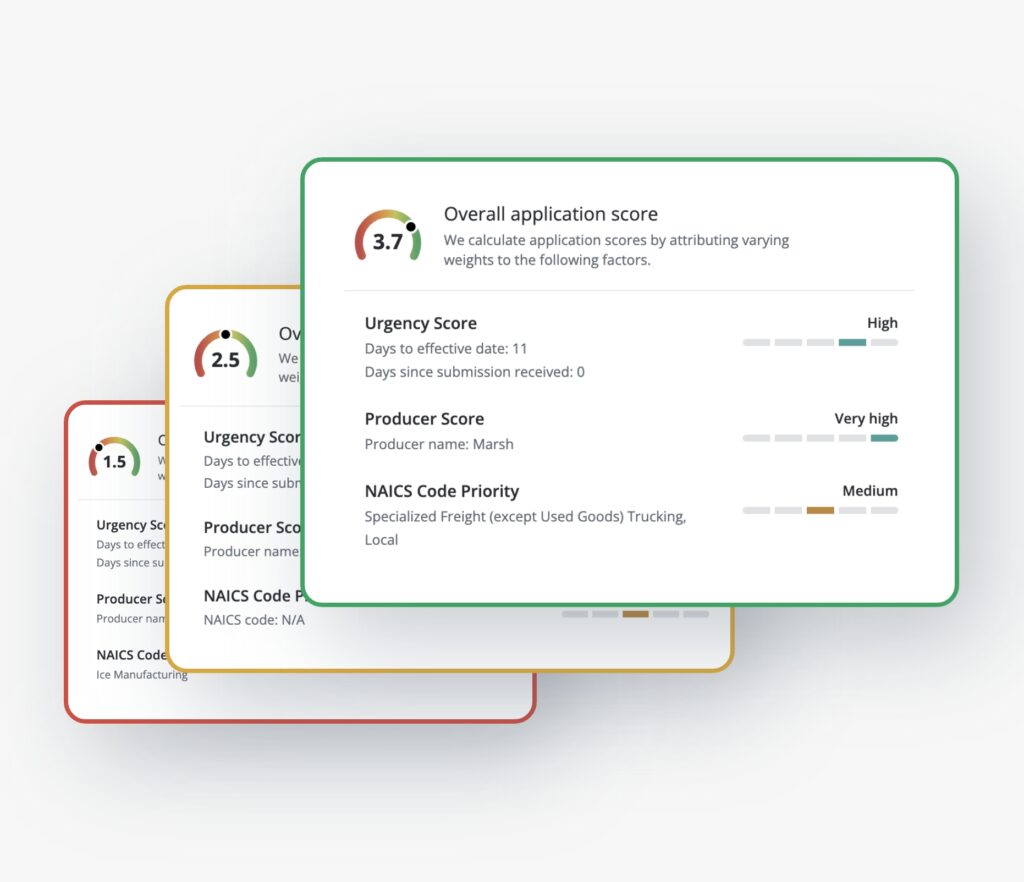

#3: Taking the newly acquired data asset and overlaying your business requirements

With this newly complete data asset at your fingertips, the last step in the process is applying some type of logic to help quickly surface the best opportunities. There are workflow tools that enable you to set rules specifically for your business requirements that are then automatically applied to all completed submissions. In the case of SubmissionIQ, the end result is a total application score applied to your entire submission pipeline that you can use to easily prioritize areas of focus and make informed, efficient decisions.

Bonus: Similar to enrichment, experiencing this systematic prioritization through a user interface where you can customize the dashboard, click into a specific submission for more detail and take bulk actions (i.e., assign for underwriting review, move to decline, etc.) is powerful.

If you’d like to learn more about how Groundspeed and SubmissionIQ can help, reach out to [email protected].