Groundspeed was acquired by Insurance Quantified in 2023.

Loss history is a crucial component of any commercial insurance submission, as underwriters rely on past trends to estimate future loss activity and determine if an account falls within its risk appetite. A complete loss history comprises both closed claims, where the severity of the loss is clear, and, in many cases, open claims, where the final total incurred is unknown. Reserves set aside by the current carrier offer some information on open claim development, but reserving practices vary by carrier and are often inaccurate. As a result, open claims add an unwelcome degree of uncertainty to risk assessment, which can lead to adverse selection, pricing inaccuracy, or even missing out on profitable business.

For insurers, loss reserves are one of their most significant liabilities. While actuarial teams do their best estimating loss reserves, it becomes a bigger challenge when there are many open claims to deal with. This can lead to over or under estimate future loss payments. Unfortunately, this has long been the norm that insurers had to work with, but what if you could get a better understanding of how open claims would ultimately evolve?

Groundspeed’s Solution

Groundspeed is uniquely positioned to tackle this problem thanks to our large contributory insurance dataset, which currently contains over 32 million claims from over 300,000 US companies across all major lines of business.

We have combined years of domain expertise with our expansive dataset to train a model that can predict the final total incurred on an open claim with greater accuracy, on average, than the current carrier reserves. It leverages over 100 different data points extracted from loss runs, everything from loss descriptions and line of business to financial values and dates, as well as features derived from other Groundspeed models (ex., at-fault classification for auto claims). Since both carrier reserving practices and claim development differ significantly by line of business. We’ve also taken care to consider these differences in the model, which leverages this feature when predicting open claim outcomes.

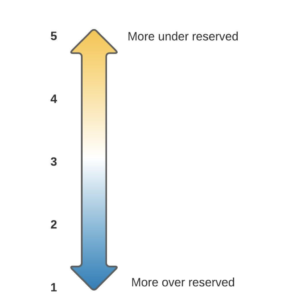

The Groundspeed Reserve Score is provided for each open claim. This score is expressed as a value on a 5-point scale, which indicates both the direction and magnitude of under/over reserving for the open claim.

5 – total incurred is less than half the expected total paid (reserves are very low)

4 – total incurred is approximately half the expected total paid (reserves are low)

3 – total incurred is approximately equal to the expected total paid (properly reserved)

2 – total incurred is approximately double the expected total paid (reserves are high)

1 – total incurred is greater than double the expected total paid (reserves are very high)

Using this scale, Groundspeed helps carriers understand the degree of risk by describing the possible outcomes (over or under reserved) and the distribution of the severity of possible outcomes; i.e., we convey information about the expected value of open claims. The score that we provide combines information about the probability of a claim ending up over or under-reserved and the magnitude of the possible outcomes.

For example, a claim with a high probability of being under-reserved by a large amount, but a low probability of being over-reserved would receive a “5.” A claim with a high probability of being under-reserved, but to a lesser extent, would receive a “4.” Claims with equally-high uncertainty in both directions of over and under-reserving receive a “3.” Thus, the greater the number, the higher the overall expected probability of severely under-reserving.

Since both carrier reserving practices and claim development differ significantly by line of business, we’ve also taken care to consider these differences in the model, which leverages this feature when predicting open claim outcomes.

Outcome

We tested our model’s results using linked claims. Linked claims are pairs for which we have both the open (earlier) and closed (later) states. In comparing predictions and truly closed states, we found that our model can reliably classify whether a claim is under or over-reserved, and more importantly, the model’s predicted final total incurred represented a significant reduction in error over the current carrier’s reserves on average.

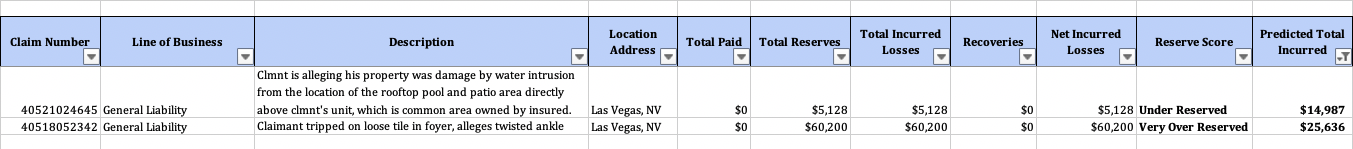

A loss reserve prediction is displayed alongside key claim data points.

Armed with this unique insight into open claim development, underwriters can better evaluate a prospective insured’s loss history. An obvious use case is to avoid (or appropriately price) risky accounts with under-reserved open claims, but the potential to identify over-reserved claims also presents an opportunity. For example, underwriters can identify and win new business that the market may be over-pricing due to high reserves, and thanks to those same reserves, they can write it at a profitable premium. Additionally, loss reserve predictions can save underwriters time by flagging open claims that do or don’t warrant detailed follow-up with the agent.

Get the most comprehensive view with Groundspeed

Pairing these loss reserve predictions with Groundspeed’s data products gives commercial underwriters the most comprehensive possible view into an insured’s loss history, empowering them to write more profitable business while minimizing risk exposure.

If you are interested in learning more about Groundspeed’s Human in-the-loop AI platform, request a demo with our team today. It’s time to unlock the value in your unstructured data, so you can evaluate real risk faster.

This blog was written in collaboration by:

Alex Findlater – Alex is a data scientist at Groundspeed. Alex is focused on researching and developing model-driven process automations and risk products for underwriters.

Andrew Waters – Andrew Waters is the Director of Product Management. Andrew works directly with our customers, expanding our portfolio of model-driven data insights and defining the next generation of data products at Groundspeed.

Vishal Srivastava – Vishal is our Senior Vice President of Engineering and leads the data engineering, science, enablement and document automation efforts at Groundspeed. At Groundspeed, Vishal is focused to bring substantial value to our clients by building intelligent document processing and risk products.